Investor Roundtable: Surfing the Tide – What Accepting VC Funding Means

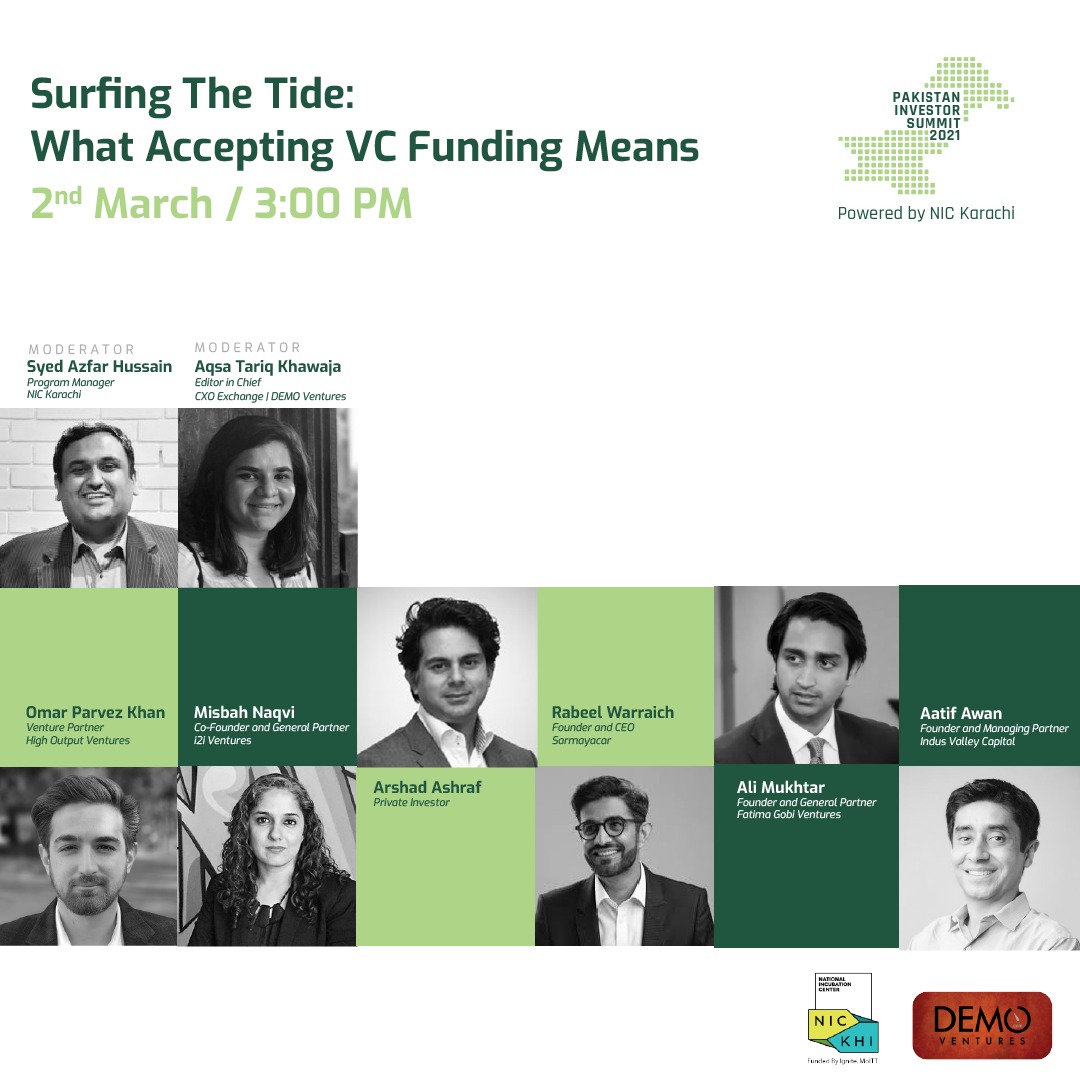

The Investor Roundtable organized by National Incubation Center Karachi in partnership with DEMO Ventures was held on 2nd March 2021. The roundtable was part of a series of events led by NIC Karachi in lieu of the Pakistan Investor Summit 2021 organized by Ignite. The session hosted prominent venture capitalists and private investors from the local Pakistani ecosystem including:

- Omar Parvez Khan, Venture Partner – High Output Ventures

- Misbah Naqvi, Co-founder & General Partner – i2i Ventures

- Arshad Ashraf, Private Investor

- Rabeel Warraich, Founder & CEO – Sarmayacar

- Ali Mukhtar, Founder & General Partner – Fatima Gobi Ventures, and

- Aatif Awan, Founder & Managing Partner – Indus Valley Capital

Aqsa Tariq from DEMO Ventures and Azfar Hussain from NIC Karachi jointly moderated the roundtable.

The conversation started with a recap of recent developments in Pakistan’s startup ecosystem. Taking the lead on this, Mr. Aatif talked about how in the past two years, Pakistan has truly had unique value added to its startup ecosystem. While early 2019 felt like an uphill battle for funds with increasing pessimism and skepticism, there’s now excitement over a really large market. Operators and executives at some of the largest companies are being targeted, there are people in companies with a direct vested interest in the Pakistani ecosystem success- these are all positive changes.

Mr. Ali then talked about the importance of understanding the dynamics that surround venture funding- especially comprehending the amount of funds that will be needed, and what milestones can be reached with that.

Ms. Misbah’s thoughts aligned with her co-panelists, as she expanded on the idea of different kinds of funding in the event of a failed venture approach. While there are certain angel investors and grants available, one thing are abundantly clear- there needs to be a lot more development when it comes to the different paths available for funding. Additionally, we need to acknowledge the role that technology plays in this ecosystem- as she said, “tech based models have the potential to grow very fast,” and this is where we need to focus.

Capital Formation

As far as Pakistan’s investment landscape is concerned, Mr. Arshad breaks it down and details out capital formation.

“When countries look at stock markets, equity markets; that’s where capital comes first, it’s easy for it to come there,” he said. However, capital formation is only $70 billion in Pakistan in terms of market capitalization as compared to Bangladesh’s $80 billion and India’s $1.8 trillion. This means that when our biggest market is not visible globally for investors, the smaller markets don’t get funding either, because there is no trickle down effect.

Now with alignment, there are mechanisms with which local startups can find a path to exit and also tap into the equity markets to grow. Then the Pakistani market can grow, so attention is diverted to public stocks, then private stocks; which leads it to venture capital eventually. Additionally, he elaborated on capital as a commodity and our biggest asset being our demographic, we need to find more talent. Capital may be moveable, but labor is not, and that can be tapped into in Pakistan.

Mr. Omar was also able to shed some light on the way the Pakistani market has changed, as well as what businesses can expect from taking the path of venture funding. According to him, the past two years have brought with them an acceleration in terms of knowledge of funding as well as developments, five years ago, VC funding was less, and so was knowledge about it. Now, startups are aware of the path they wish to take, and how to go about it. However, the problem remains in a lack of avenues for VC funding. Very few models are suitable for grants, hence some businesses end up making changes to their model for the desired funding. However, this means that their model ends up becoming something they did not desire, nor anticipate, putting a roadblock in their plans.

It is also important to remember that over a long period of time startups will have to make monetary sacrifices. With a relatively low market salary, as an entrepreneur one makes a leap, it is a risk. However, it is important to not only align with the investor, but also have an understanding with the founders. Ms. Misbah, for example quoted one from i2i’s investment portfolio, TelloTalk. This is a company founded and led by people who have been working together for 15+ years, and like she says “there is a certain kind of maturity and team camaraderie investors look at”.

Moreover, there needs to be an ability to think beyond the business to avoid stagnation. Only then the returns keep reaping benefits. And like Mr. Aatif advised, it’s essential to go onto this path for the right reasons, not because it’s cool, but because it could actually change Pakistan’s economy in a significant way, or bring about developments to a cause that hits home. Especially since Rabeel reminded the audience, investors are also looking for returns.

“We recognize that when we invest, we don’t want our investment to go down to 0. While there are a lot of tools and support for this path now, and more expertise and capital, it is still up to the startups to take responsibility for this”

Moreover, from an investor’s perspective, all the eggs cannot be in one basket. If investor’s funds are all linked to the same startup, it indicates a mismanagement of funds. Diversification is a big part of this process, especially because this is a risky game. If nine out of ten startups fail, but one succeeds, that still brings back the returns to those investors who were also promised their capital, as Mr. Rabeel elaborated.

Luckily, as Pakistan receives more and more investors who bring capital and expertise to Pakistan after success overseas, it also receives more and more founders who grow mature and bring their own knowledge and skills set to the table, like Ms. Misbah pointed out. “There’s actual transfer of knowledge,” she said. However, in Pakistan, financial equity is still given far more importance than sweat equity. In that case, we need to come together to form new solutions that allow us to keep up with the rest of the world.

Fortunately, regulators are now listening to feedback, and making due changes, which bodes well for the startup ecosystem. There’s also a mental change where people are seeing that technology can solve a lot of our problems. However, we still lack angel-funding avenues as Mr. Omar pointed out, which means there is a leak in the pipeline, a roadblock on the path to venture funding. Nevertheless, like Mr. Rabeel said,

“The Pakistani ecosystem has ninety-nine problems but lack of funding isn’t one.”

Ms. Misbah and Mr. Ali also echoed these thoughts, sharing that while surveys indicate there needs to be a lot more done on the part of accelerators and incubators, there have been promising developments and improvements. If startups can just look at their own space, work by their own core principles, and put in hard work and correct market strategies, there is no reason a perfect ecosystem cannot be created in Pakistan.